defer capital gains tax canada

Capital gains deferral B x D E where. Under the current Canadian federal income tax rules when a rental real estate property is sold the owner must pay tax on the recaptured CCA at up to 48.

Capital Gains Tax In Canada Explained Youtube

Deferral election is not taken but can claim CCA.

. The inclusion rate has varied over time see graph below. A Brief History of the Capital Gains Tax in Canada. B the total capital gain from the original sale.

Claim a capital gains reserve. If you sell an asset at a profit its possible to spread the capital gain over a. The inclusion rate is the percentage of your gains that are subject to tax.

Individuals other than trusts may defer capital gains incurred on certain small business investments disposed of in 2021. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs. The gain is deferred until December 31 2026or to the year when the.

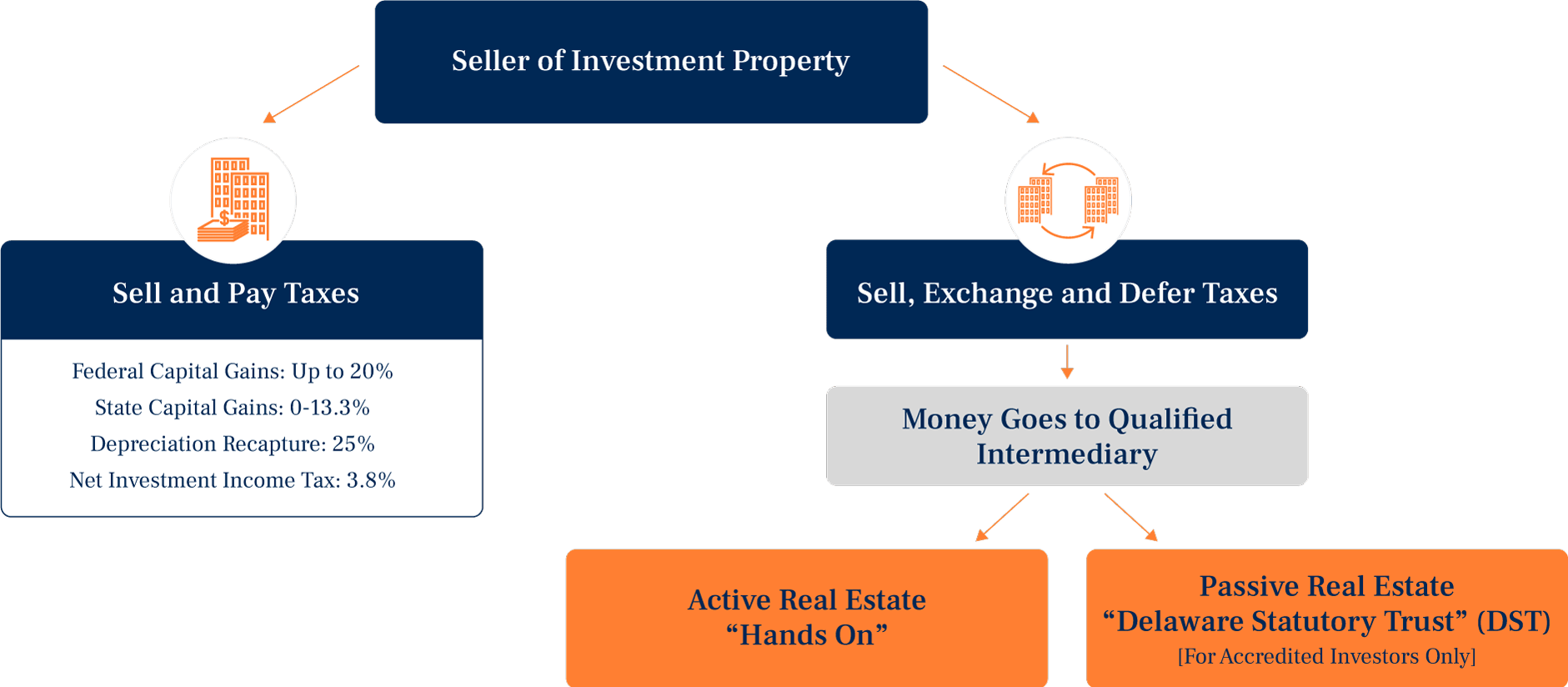

In Canada can you defer capital gains tax by re-investing the capital gain back into more real-estate like they are able to do in the States. For a gain to be deferrable it must be invested in a QOF within 180 days of the sale that resulted in the gain. Without the deferral election the appreciation of 250000 from Year 1 to Year 5 is taxable in Year 5 even though you didnt truly.

The first way to avoid paying capital gains tax on rental property in Canada is to defer the sale of your property to a later date. Under current law short-term capital gains are treated as ordinary income with a top tax rate of 408 370 plus 38 net investment income tax NIIT. Use the IRS Primary Residence Exclusion If Applicable While not specifically related to the sale of a commercial property IRS rules allow taxpayers to reduce.

1972 - it started with a 50 Inclusion Rate and all prior. If you earned a capital gain of 10000 on an investment 5000 of that is taxable. In Canada taxpayers may defer and roll capital gains into replacement properties under either section 44 or 441 of the Act.

The 1031 exchange enables investors to defer taxes on capital gains from property. The 1031 exchange originated from Internal Revenue Code IRC section 1031 in the US. National 1031 Exchange Services.

Section 44 applies to a property that. As of 2022 it stands at 50. Here are six creative ways to defer a tax bill until a future year.

This deferral applies to dispositions where you use. Trusts Wills and Probate for CA 408 437-7570. D the lesser of E and the total cost of all replacement shares.

TAX DEFERRAL ON REINVESTMENT. January 1 2022 is the 50th anniversary of the capital gains tax. Comments for Deferal of capital gains.

E the proceeds of disposition. This can be done using Section 1031 of the tax.

Too Many Analyses Misrepresent Capital Gains Income And Taxes Fraser Institute

1031 Exchange Investment Properties Marcus Millichap

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

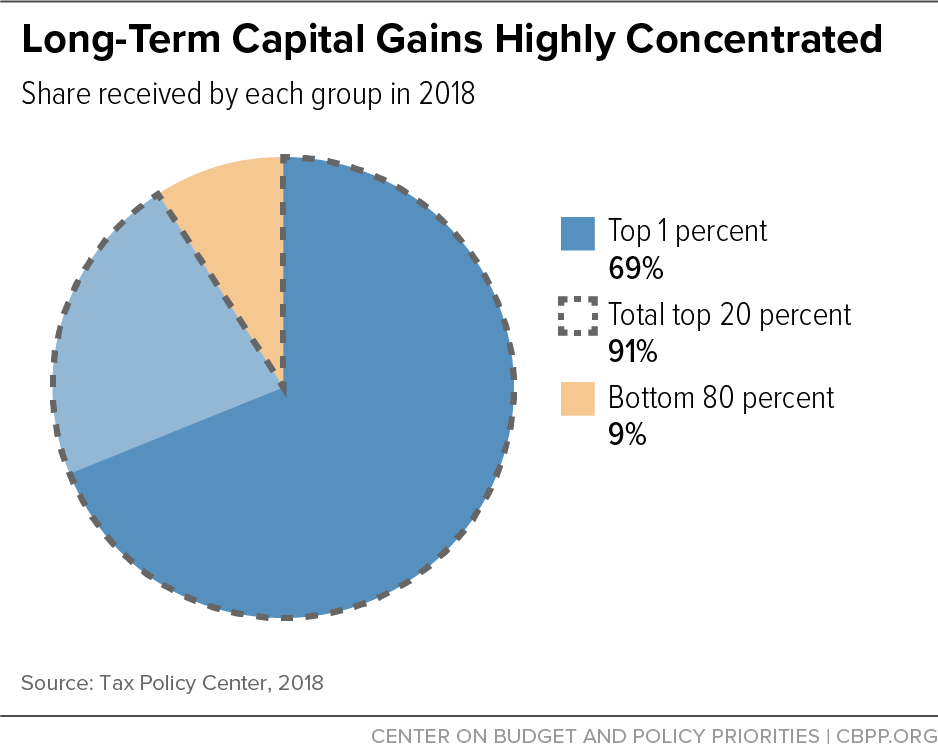

How Are Capital Gains Taxed Tax Policy Center

How To Avoid Capital Gains Tax In Canada Remitbee

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Smythe Llp Possible Changes Coming To Tax On Capital Gains In Canada

Six Ways To Avoid Capital Gains Tax In Canada 2022 Wealthsimple

Can You Avoid Capital Gains By Buying Another Home Smartasset

Investment Income Taxation Intelligent Design Or Jurassic Park Physician Finance Canada

How Do I Report Capital Gains In British Columbia

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

Capital Gains Tax In Canada Explained

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

What Is Tax Gain Harvesting Charles Schwab

Capital Gains Tax On Stocks What You Need To Know The Motley Fool